Spain, Espana International moving companies

Spain International Removals To Espana

Mudanzas Internacionales en España | Servicios Confiables

Imagine relaxing on a sunny beach somewhere in Spain / Espana while we handle all the details of your international move for you because that what we do best. Our dedicated international removals team and partners will ensure your move to Spain / Espana is smooth and stress-free. We are recognised as one of the top Spain / Espana international moving companies, providing unparalleled service and reliability.

Removals from the UK to Spain

Traslados al Extranjero desde Madrid | Expertos en Mudanzas

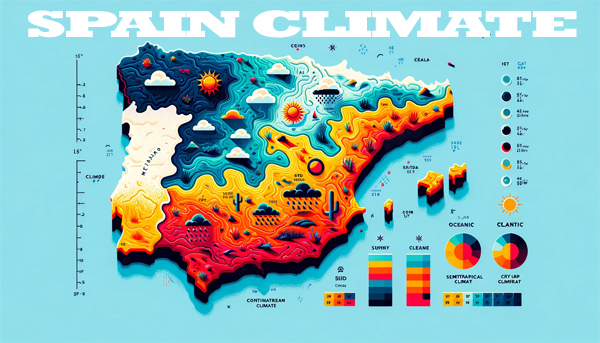

Spain is a popular place to live because of its vibrant culture and sunny weather. We move people to Spain / Espana often, so we know how to do it quickly and efficiently. Our global partners help us manage every part of your move, from shipping to customs.

Why Choosing the Spain International Moving Movers Is Important

Mejores Empresas de Mudanzas Internacionales en España

Choosing the best international moving movers when moving to Spain is very important. Good removal companies know how to handle your things carefully, making sure they arrive safely. They help pack, transport, and deliver your belongings, making the whole moving process easier and less stressful for you and your family.

Additionally, the best Spain movers moving company provide insurance to protect your valuable items during the move. They can also help with unpacking and setting up your new home. By selecting reliable Spain movers, you ensure a smooth and worry-free move, allowing you to enjoy your new life in Espana right away.

Compare Spain / Espana Movers - 🇪🇸 🇬🇧 🇪🇺

Gerson Moving Services

- 🛡️ Insurance: ✅ Yes

- 📦 Packing Service: ✅ Yes

- 🏅 Accreditation: ✅ IAM, FIDI, BAR

- 📍 Local Expertise: 🇪🇸+🇬🇧+🇪🇺

Bishop’s Move

- 🛡️ Insurance: ✅ Yes

- 📦 Packing Service: ✅ Yes

- 🏅 Accreditation: ✅ IAM, FIDI, BAR

- 📍 Local Expertise: 🇪🇸+🇬🇧+🇪🇺

Abels

- 🛡️ Insurance: ✅ Yes

- 📦 Packing Service: ✅ Yes

- 🏅 Accreditation: ✅ IAM, FIDI, BAR

- 📍 Local Expertise: 🇪🇸+🇬🇧+🇪🇺

Spain International Movers In Espana

Our team of Espana and Spain international moving movers and packers are experts in taking care of your things. They are trained to handle your belongings with great care. Reviews for Spain international moving companies are very positive. We are committed to providing the best service and making sure our clients are happy. Espana and Spain international moving companies have great reviews, showing how good we are at what we do. We work hard to make your move smooth and worry-free.